The Basic Principles Of Medigap

Wiki Article

How Medigap can Save You Time, Stress, and Money.

Table of ContentsNot known Facts About What Is MedigapGetting My Medigap Benefits To WorkMedigap for BeginnersThe Best Guide To MedigapThe Greatest Guide To What Is Medigap

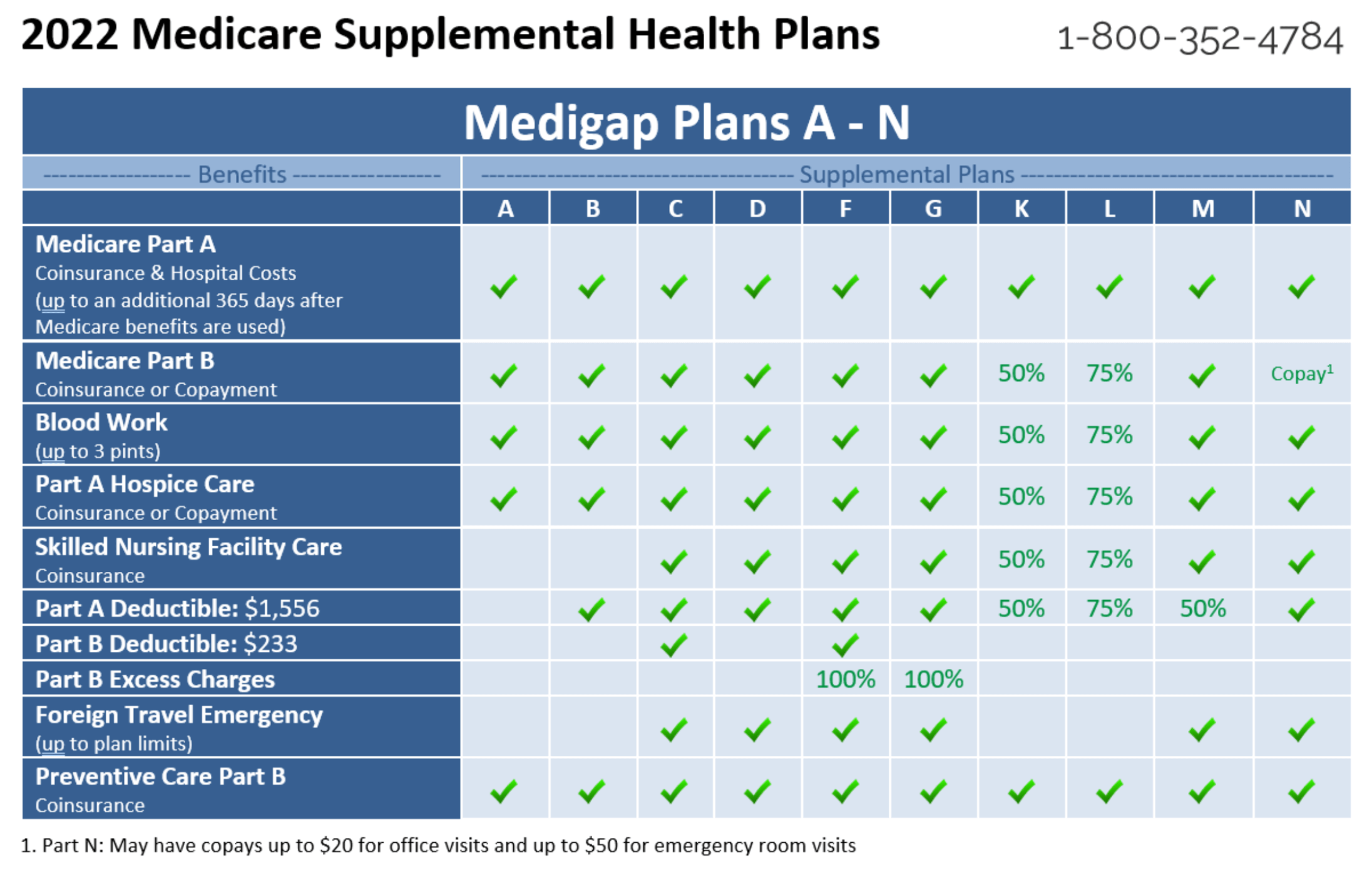

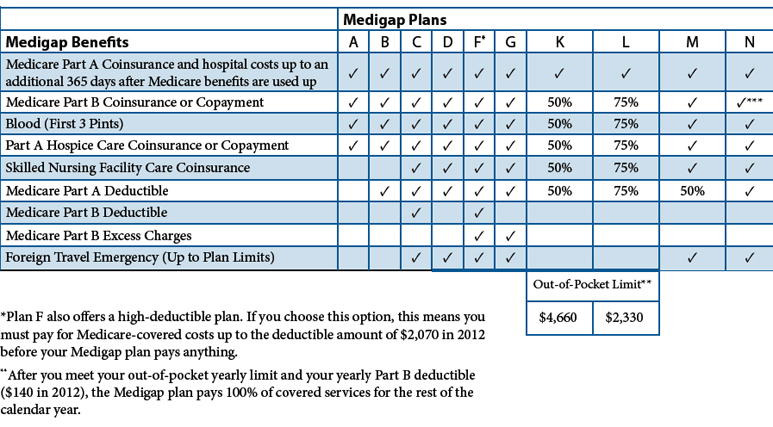

A strategy may cover only 75% instead than 100% of the Medicare Component An insurance deductible. Depending on your income degree, the state Medicaid program might pay component or all of your Medicare Component B costs, and perhaps other prices. If you have Medicare Part D, Roland suggests looking for Extra Aid, a federal aid with repayment aid for Part D costs, deductibles as well as co-insurance.Although you may hear it called various names, they are the same point. Medigap or Medicare Supplement insurance coverage work to cover any type of shortages or "gaps" that Original Medicare (Components An and B) does not spend for. Medigap insurance coverage is sold by personal insurer. By regulation, business can just provide basic Medigap insurance strategies.

Nevertheless, Plans An and B do not offer coinsurance for skilled nursing facility treatment, but the other strategies do supply help (Medigap benefits).

We're on a mission, serving with enthusiasm, function and also a smile!

Some Known Factual Statements About How Does Medigap Works

To determine the appropriate fit, it is necessary to know what makes these insurance coverage options various. It truly depends on your demands, and each kind of plan can have benefits and drawbacks. To start, concentrate on what you're truly looking for, consisting of out-of-pocket expenses, prescription drug insurance coverage, additional benefits and more.

Fringe benefits: Numerous strategies offer protection for vision, dental, hearing as well as even more. Network selection: For the most affordable costs, you ought to see medical professionals and wellness care companies who belong of the plan's network. Many plans will certainly supply some kind of out-of-network protection, also yet it might have higher cost-sharing.

The Definitive Guide to What Is Medigap

Relying on your monetary scenario and your health and wellness treatment demands, the strategy that functions best for you may change gradually yet registering in either a Medicare Advantage or Medicare Supplement plan can assist with prices not covered by Initial Medicare.Medicare Select is a kind of Medigap plan that needs insureds to utilize certain health centers and also in many cases particular physicians (except in an emergency) in order to be eligible for complete benefits. Aside from the constraint on hospitals and suppliers, Medicare Select plans have to meet all the requirements that relate to a Medigap policy.

When you make use of the Medicare Select network healthcare facilities and also companies, Medicare pays its share of accepted charges as well as the insurer is in charge of all supplementary advantages in the Medicare Select policy. Generally, Medicare Select policies are not required to pay any kind of advantages if you do not utilize a network company for non-emergency services.

The Medigap payment choices may differ depending on the insurance firm, however here are some usual methods to pay your Medigap premium:: You can establish up automatic repayments from your bank account so that your Medigap costs is automatically deducted each month.

Medigap Fundamentals Explained

You will certainly not even see the bill but you might get an "explanation of invoicing" that reveals who paid what. If your Medigap plan doesn't cover the Component B insurance deductible and also you have not yet met your deductible for the year, you will require to pay that quantity before your Medigap plan will certainly start covering expenses.If, not you can call your representative or the insurance supplier straight.

While Medicare Part An and also Component B benefits originate from the federal government, Medicare Supplemental plans have actually benefits supplied by personal insurance coverage carriers. These providers costs Medicare first and also charge the continuing to be amount to the Medigap carrier. In 47 states, Medigap plans are identified by letters A with N. Each lettered plan uses a different insurance https://www.paulbinsurance.com/medigap/ coverage level.

In addition, it is necessary to note that if you have a Medicare Supplement policy and also your spouse needs protection, they must get a different policy. Typically, Medicare Supplement plans offer private insurance coverage, so you and your spouse can not share a policy. Nonetheless, not having the ability to share a policy provides a lot more positives than downsides for spouses.

Not known Facts About Medigap

Ronald as well as Carolyn are a wedded pair turning 65 as well as enlisting in Medicare. When enrolling in a Medicare Supplement plan, Ronald desires something low-priced to cover him in an emergency.When you enlist in a Medicare Supplement strategy throughout this time, you have actually assured concern rights. You may still enroll in Medicare Supplements outside your Medigap Open Registration Duration home window, yet you might be subject to wellness questions.

Report this wiki page